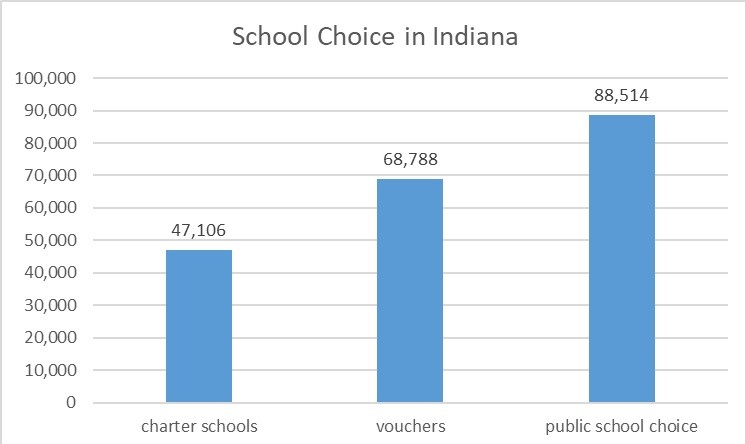

The term school choice usually refers to charter schools and private-school vouchers. In Indiana, the biggest choice program remains “public school choice,” students attending a public school in a district other than the one in which they live.

More than 88,000 Hoosier students crossed district lines to attend a public school in fall 2023, according to the Indiana Department of Education public corporation transfer report. That compares with nearly 69,000 who received state-funded private school vouchers and 47,000 who attended charter schools.

Most school corporations have accepted cross-district transfers since 2009, when Indiana shifted most school funding from local property taxes to the state budget. Districts benefit from admitting more students because they get more state funding, assuming they have room for additional students.

The system is popular, but it’s not for everyone. Families that transfer must provide transportation, so it favors those with resources and flexibility. Students are more likely to transfer from high-poverty to low-poverty districts than vice versa. Districts that lose the most students to transfers tend to be compact urban districts hemmed in by suburban or rural districts: e.g., Kokomo, Anderson, Muncie and Marion.

Continue reading